Economic policy of the Joe Biden administration

The economic policy of the Joe Biden administration, or "Bidenomics" is characterized by relief measures and vaccination efforts to address the Coronavirus pandemic, investments in infrastructure, and strengthening the safety net, funded by tax increases on higher-income individuals and corporations. Other goals include: increase the national minimum wage and expand worker training; narrow income inequality; invest in clean energy; expand access to affordable healthcare; and forgive student loan debt.[1] The March 2021 enactment of the American Rescue Plan to provide relief from the economic impact of the COVID-19 pandemic was the first major element of the policy. Biden's Infrastructure Investment and Jobs Act was signed into law in November 2021 and contains about $550 billion in additional investment. His Build Back Better Act passed the House in November 2021 and is pending in the Senate.

| ||

|---|---|---|

|

Incumbent Tenure

Presidential campaigns Vice presidential campaigns Published works

|

||

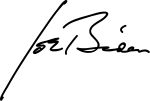

Biden's first year in office saw robust growth in real GDP, employment, wages and stock market returns amid significantly elevated inflation.

Overview

President Biden inherited a challenging economic and budgetary situation from President Trump, due significantly to the continuing COVID-19 pandemic. As of December 2020, the jobs level was nearly 10 million (6%) below the early 2020 peak, and the unemployment rate was an elevated 6.7%.[2] There was a record budget deficit in fiscal year 2020 of $3.1 trillion, or 14.9% GDP.[3]

Biden's first major legislative response was the American Rescue Plan Act enacted in March 2021, a $1.9 trillion package that included $1,400 checks per adult, an expanded child tax credit for a year with $250-300 monthly checks per child expected to drastically reduce child poverty, extended unemployment benefits, and expanded eligibility for healthcare benefits, among others. The primary impact was in fiscal year (FY) 2021, with a smaller impact in FY2022. No Republicans in the House of Representatives or the Senate voted for the Rescue Act.

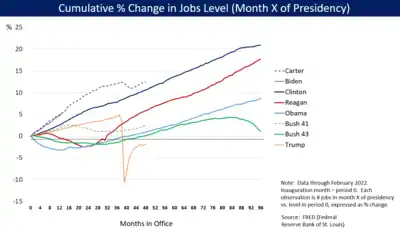

Biden followed-up with the Infrastructure Investment and Jobs Act, signed into law in November 2021. It authorized infrastructure investment of $1 trillion total over a decade for roads, bridges, airports, sea ports, rail, broadband, water, and public transit, among others. CBO estimated the deficit impact at $250 billion total, as they considered prior infrastructure investment trends as a baseline for comparison. The law passed the Senate in bi-partisan fashion, 69-30.[4]

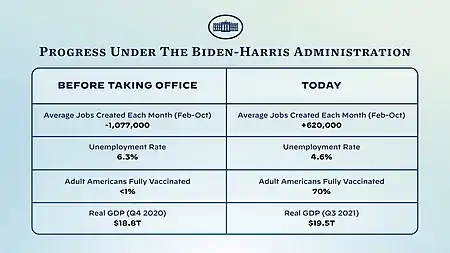

Real GDP grew 5.7% during Biden's first year, the fastest rate since 1984.[5] Amid record job creation, the unemployment rate fell at the fastest pace on record during Biden's first year, from 6.4% in January 2021 to 3.9% by December 2021.[6][7] However, inflation significantly increased in 2021 relative to 2020 in the U.S. and Europe, attributed to factors such as strong consumer demand for goods (empowered by government relief programs), supply restrictions in port capacity and microchips, and lower 2020 prices.[8][9] Inflation was partially offset by strong wage growth; by one measure, worker wages and benefits increased at the fastest rate in at least 20 years.[10][11] The administration noted that high inflation was also present in the Eurozone, Canada and the United Kingdom, though economists said the $5 trillion in government stimulus spending in the United States during 2020 and 2021 was disproportionately large compared to that of other countries and was a significant contributor to domestic inflation.[12] Despite the pandemic and inflation challenges, Bloomberg News reported in November 2021 that the S&P 500 stock market return of 37.4% in Biden's first year (measured from election day) was the highest of any modern president.[13] CBO forecast in July 2021 that the budget deficit in fiscal year 2022 (Biden's first budget year) would be $1.2 trillion, versus around $3 trillion in FY2020 and 2021.[14]

Statistical summary

First year: January 2021 to January 2022

| Variable | January 2021 | January 2022 | Change | % Change |

|---|---|---|---|---|

| Jobs, level (millions)[16] | 143.0 | 149.6 | +6.6 | +4.6% |

| Unemployment rate %[17] | 6.4% | 4.0% | -2.4 pp | n/a |

| Number unemployed (millions)[18] | 10.1 | 6.5 | -3.6 | -36% |

| Real GDP level ($ trillions)[19] | 19.06 Q1 '21 | 19.81 Q4 '21 | +0.75 | +3.9% |

| Inflation (CPI-All % Change vs. Year Ago)[20] | 1.3% | 7.5% | +6.2 pp | n/a |

| Wages ($/Hour Production & Non-Supv.)[21] | $25.18 | $26.92 | +1.74 | +6.9% |

| Budget deficit ($ billions)[22] | 2,772 FY '21 | 1,153 FY '22 F | -1,619 | -58% |

| Stock market S&P 500[23] | 3,852 | 4,516 | + 664 | +17.2% |

| Debt held by public ($ trillions)[24] | 21.6 | 23.6 | +1.9 | +8.8% |

January 2021 to Latest Period

| Variable | January 2021 | March 2022 | Change | % Change |

|---|---|---|---|---|

| Jobs, level (millions)[16] | 143.0 | 150.9 | +7.9 | +5.5% |

| Unemployment rate %[17] | 6.4% | 3.6% | -2.8 pp | n/a |

| Number unemployed (millions)[18] | 10.1 | 6.0 | -4.1 | -38% |

| Real GDP level ($ trillions)[19] | 19.06 Q1 '21 | 19.81 Q4 '21 | +0.75 | +3.9% |

| Inflation (CPI-All % Change vs. Year Ago)[20] | 1.3% | 8.5% | +7.2 pp | n/a |

| Wages ($/Hour Production & Non-Supv.)[21] | $25.18 | $27.06 | +1.88 | +7.5% |

| Budget deficit ($ billions)[22] | 2,772 FY '21 | 1,153 FY '22 F | -1,619 | -58% |

| Stock market S&P 500[23] | 3,852 | 4,530 | + 678 | +17.6% |

| Debt held by public ($ trillions)[24] | 21.6 | 23.9 | +2.3 | +10.6% |

American Rescue Plan Act

Biden's $1.9 trillion relief package, the American Rescue Plan Act, was signed into law in March 2021. Many observers identified it to be the largest social welfare initiative undertaken by the federal government in decades, and economists predict low income households will benefit the most from the plan.[25] Analysts also predict that the adult poverty rate could be cut by a quarter, and the child poverty rate cut by half as a result of its passage.[26]

The key elements of the Rescue Act include:

- $1,400 direct payments to individuals earning up to $75,000 a year;

- Extending expanded unemployment benefits through the end of September 2021;

- Increased the value and expanded eligibility for the child tax credit; to $3,600 per child under age 6 and $3,000 per child ages 6-17, up from $2,000. An estimated 39 million families with children will receive the additional benefits. Payments are scheduled monthly for July to December 2021, with the remaining six months of benefits due when the tax return is filed for 2021. The credit was changed from non-refundable to refundable, meaning those with low income who previously didn't have sufficient tax liability to receive the credit, will now receive the payment. This is a one-year program, that the administration hopes to make permanent.[27]

- $130 billion to primary and secondary schools;

- $45 billion in rental, mortgage, and utility assistance;

- Billions for small businesses;

- $14 billion for a national vaccine program, including preparation of community vaccination centers;

- $350 billion to help state, local, and tribal governments bridge budget shortfalls.[28]

The Tax Policy Center reported that the law would cut taxes by an average of $3,000 per household and raise after-tax incomes by an average of 3.8% in 2021, with 70% of the benefit going to lower- and middle-income households. This is in sharp contrast to the Tax Cuts and Jobs Act, in which half of the benefits went to the top 5% highest income households.[29]

American Jobs Plan

In March 2021, Biden proposed a $2.65 trillion infrastructure package known as the American Jobs Plan with investments over 10 years, fully paid for by corporate tax increases over 15 years. A White House fact sheet described the plan: "This is the moment to reimagine and rebuild a new economy. The American Jobs Plan is an investment in America that will create millions of good jobs, rebuild our country's infrastructure, and position the United States to out-compete China." The fact sheet further described the U.S. as ranking 13th in the world in infrastructure, with a vulnerable electrical grid. It expands the concept of infrastructure from physical assets like roads and bridges, to human infrastructure investments like caregiving and training.[30]

The Committee for a Responsible Federal Budget (CRFB) summarized the investments as follows ($ in billions):

- Climate $782

- Transportation $447

- Health & Childcare $443

- Housing & Buildings $258

- Jobs & economic development $196

- Research & Development $159

- Manufacturing $154

- Clean water $111

- Broadband $100

CRFB also summarized the revenue elements over 15 years:

- Increase corporate tax rate from 21% to 28%, generating $1,300 billion in revenue. The rate had been lowered from 35% in 2017 to 21% in 2018 by the Tax Cuts and Jobs Act.

- Implement a global minimum tax, raising $750 billion.

- Several other elements to address corporate tax loopholes and shelters, raising $680 billion.[31]

Infrastructure Investment and Jobs Act

The Infrastructure Investment and Jobs Act is a key pillar in Biden's American Jobs Plan. It passed the House and Senate and was signed into law on November 15, 2021. While referred to as the $1 trillion infrastructure plan, it includes $550 billion in additional spending beyond previous legislation and was scored by the CBO to add about $250 billion to the deficit over a decade. It includes many of the spending elements summarized above by the CRFB, but in different amounts: Roads and bridges ($110B), power infrastructure ($73B), passenger and freight rail ($66B), broadband ($65B), clean drinking water ($55B), western water storage ($50B), public transit ($39B), Airports ($25B), water & soil purification ($21B), ports ($17B), electric vehicles ($15B) and transportation safety programs ($11B).[4]

American Families Plan

In April 2021, Biden proposed "The American Families Plan", which a White House fact sheet described as: "[A]n investment in our children and our families—helping families cover the basic expenses that so many struggle with now, lowering health insurance premiums, and continuing the American Rescue Plan's historic reductions in child poverty." The plan elements include:

- Adding at least four years of free education, including two years of pre-school for 3-4 year-olds, and two years of community college. The Biden Administration estimates the pre-school program will benefit 5 million children each year and save the average family $13,000. The community college program will help about 5.5 million students per year pay $0 in fees, about $109 billion over a decade.

- Providing child care subsidies to limit spending of low- and middle-income families to 7% of income.

- Creating national paid family and medical leave program, comparable to other developed nations.

- Expanding food assistance, including in schools to reduce child hunger.

- Extending tax cuts in the American Rescue plan indefinitely, including the Child Tax Credit, Earned Income Tax Credit, and the Dependent Care Tax Credit.

- Expanding healthcare subsidies in the American Rescue plan indefinitely, including $50/month subsidies (on average) received by nine million people.[32]

The New York Times estimated the American Families Plan would invest about $1.8 trillion over 10 years, with about $800 billion in tax credits, $545 billion in child and family support, $511 billion for education, and $80 billion to expand the ability of the Internal Revenue Service to collect taxes from the wealthy.[33]

Build Back Better Act

The Build Back Better Act, a reconciliation package including about $2.2 trillion in spending/investments and $2.0 trillion in additional revenue over a decade, passed the House of Representatives November 19, 2021 and is pending before the Senate. Most of the bill's provisions have finite duration.

The New York Times reported that enacting the bill would fund benefits such as:[34]

- Child care program for children up to five years of age, capping family expenses at 7% of income ($273 billion).

- Paid family and medical leave of four weeks ($205 billion).

- Child tax credit extension through 2023 ($185 billion).

- Universal preschool for 3- and 4-year-olds ($109 billion).

- Healthcare programs, such as funds for home health care under Medicaid ($150 billion), and expansion to ACA eligibility and subsidies ($74 billion).

- Climate programs with various tax incentives, pollution controls, and financial assistance ($495 billion).

- Housing programs such as public housing, rental assistance, and affordable housing ($166 billion).

The revenue or cost reduction sources include:

- Corporate tax increases of $814 billion, including new methods such as an alternative minimum tax on accounting profits and taxing stock buybacks.

- Individual tax increases of $655 billion, focused on high-income households, including surtaxes for incomes over $10 million or $25 million.

- Allowing government to negotiate prices for Medicare prescriptions (cost reduction of $76 billion).

- Limiting prescription drug price increases (cost reduction of $84 billion).[34]

The CBO estimated the bill would add $350 billion total to the national debt over the 2022-2031 period, excluding about $200 billion in estimated collections from stronger IRS enforcement (bringing the net impact closer to $150 billion), overall a relatively minor net impact on the national debt.[34]

Biden's first budget FY 2022

President Biden published his first budget for fiscal year 2022, covering the FY2022-2031 decade. The Committee for a Responsible Federal Budget (CRFB) summarized it as follows: "The President's budget proposes about $5 trillion of new spending and tax breaks, reflecting the previously proposed American Jobs Plan, American Families Plan, and nondefense discretionary spending increases. These provisions would be partially offset with nearly $3.6 trillion of new revenue and over $200 billion of budget cuts and savings. The budget would also add $163 billion of interest costs.” CRFB estimated this as a net $1.354 trillion increase in the budget deficit over a decade, or $135 billion/year. This budget is incremental to the $2.0 trillion impact of the American Rescue Plan, which was enacted in March 2021 and already included in the baseline forecast used for the CRFB computations.[35] For scale, Trump's Tax Cuts and Jobs Act represented about $2 trillion in deficit additions over a decade, or $200 billion/year.

CRFB also commented on the economic assumptions in the budget as being comparable to other major forecasts: "The budget's growth assumptions of 2.2 percent per year over the decade and 1.9 percent per year in the second half of the decade are somewhat higher than CBO's projections of 2.0 and 1.6 percent and the Federal Reserve's 2.0 and 1.8 percent estimates. However, they are in line with the Blue Chip consensus, which is also 2.2 percent per year over the next decade and 1.9 percent per year in the longer term." CRFB commented that Biden's budget is somewhat more optimistic on unemployment rates than these other forecasters.[35]

COVID-19

January 2021

On January 22, President Biden issued an executive order intended to deliver economic relief to families and businesses. This included:

- Increasing access to food for students missing meals due to school closures and enhancing SNAP (food stamps) benefits;

- Improving delivery of direct stimulus payments;

- Request Department of Labor to clarify that workers can still access unemployment insurance if employment would have jeopardized their health due to COVID-19;

- Develop support network to help families and businesses access government benefits; and

- Require federal contractors to pay $15 minimum wage.[36]

Minimum wage

Biden's COVID-19 stimulus package, the American Rescue Plan, originally included raising the minimum wage to $15 per hour, but this was later removed after moderate Senate Democrats and Republicans objected to the proposal. A CBO study in 2019 estimated that raising the minimum wage to $15 by 2025 would increase wages for 17 million directly in that year, although the number of persons with jobs could be reduced in a range of zero to 3.7 million.[37]

Three months into office, Biden signed an executive order to increase the minimum wage for federal contractors by nearly 37%, to $15 per hour. The order went into effect for 390,000 workers in January 2022.[38][39]

Trade

The Wall Street Journal reported that instead of negotiating access to Chinese markets for large American financial-service firms and pharmaceutical companies, the Biden administration may focus on trade policies that boost exports or domestic jobs. U.S. Trade Representative Katherine Tai said the administration wants a "worker-centered trade policy".[40][41] U.S. Secretary of Commerce Gina Raimondo said she planned to aggressively enforce trade rules to combat unfair practices by China.[42]

In March 2021, Katherine Tai said that the U.S. would not lift tariffs on Chinese imports in the near future, despite lobbying efforts from "free traders" including former Secretary of Treasury Hank Paulson and the Business Roundtable, a big-business group, that pressed for tariff repeal.[43]

At the October 2021 G20 Rome summit, the Biden administration and the European Union reached agreement to rollback the steel and aluminum tariff regime that had been imposed by the Trump administration in 2018. The agreement retained some protection for American steel and aluminum producers by adopting a tariff-rate quota regime. It also ended retaliatory tariffs on American goods the EU had imposed and canceled a scheduled tariff increase by the EU.[44]

China failed by a wide margin to purchase American goods and services as agreed under the January 2020 Phase One trade deal, which expired on December 31, 2021. The Biden administration continued to formulate its China trade policy and faced a decision as to whether to reinstate some tariffs and risk retaliation, or to ignore China's breach amid elevated inflation that might be exacerbated by additional tariffs.[45]

Education

Biden has proposed paying for college tuition and pre-K for middle-class families. He also wants to forgive some or all of student loans.[46]

Student loan forgiveness

Biden supported canceling student loan debt up to $10,000 during 2020, for some borrowers. Other prominent Democrats (Senators Warren and Schumer) co-authored a resolution including cancelations up to $50,000 for all borrowers. There is an active debate about whether legislation or executive order is sufficient to cancel student loans. Critics argued that canceling student loans is regressive rather than progressive, as most with student loans are college educated and earn more. Further, the impact on college tuition pricing and access is unclear.[47]

The Federal Reserve Bank of New York reported that student loans totaled $1.5 trillion in 2019, with 43 million borrowers. The average balance was $33,500. About 14 million borrowers (33%) had balances below $10,000; 20 million (47%) had balances $10,000-$50,000, and 9 million (20%) had balances over $50,000.[48]

The Committee for a Responsible Federal Budget reported in November 2020 that canceling student loans had several pros and cons, but was a relatively ineffective economic stimulus. While household net worth would rise by $1.5 trillion if all loans were canceled, in terms of monthly spending the typical household with student loan debt would be avoiding a $200–300 monthly payment. Re-directing this savings to other spending would have limited economic impact of about $100 billion/year. One important consideration is the tax treatment of the forgiven debt; if treated as a gain (income), it would likely be taxable in the absence of legislation negating the gain, offsetting the small positive economic impact.[49]

CNBC reported that forgiving $10,000 in student debt for all borrowers would cost the government $377 billion, but forgiving $10,000 just for those with debt below $10,000 (about a third of borrowers) would cost $75 billion. Debtors in the latter category tend to be those struggling to pay off their debt.[50]

By the end of Biden's first year in office, the Department of Education had forgiven $15 billion in debt for 675,000 borrowers.[51]

Healthcare

Biden has proposed lowering the Medicare age from 65 to 60, and expanding the Affordable Care Act subsidies and eligibility.[46] Some 23 million persons age 60-64 who could directly benefit, either by paying lower insurance premiums or no longer needing to obtain their insurance through an employer. There are about 1.7 million in the 60-64 age range who are uninsured, and 3.2 million who buy coverage because they are not covered by an employer. Hospitals would receive lower reimbursement rates for age 60-64 patients that enroll in Medicare. This plan would also increase the budget deficit, although the CBO has not officially scored the proposal as of January 2021. Lowering the Medicare age is popular, with one poll indicating 85% of Democrats and 69% of Republicans support lowering the eligibility age to as young as 50.[52]

Cryptocurrency

In January 2021, Biden suspended any federal regulatory proposal related to cryptocurrency until they can be reviewed by the new administration. This change was part of a freeze for all last-minute regulations put in place by the Trump administration.[53]

During Janet Yellen's confirmation hearing for Secretary of the Treasury, Sen. Maggie Hassan (D-N.H.) asked about the use of cryptocurrency by terrorists and other criminals. "Cryptocurrencies are a particular concern," Yellen responded. "I think many are used—at least in a transactions sense—mainly for illicit financing." She said she wanted to "examine ways in which we can curtail their use and make sure that [money laundering] doesn't occur through those channels."[54]

Unions

Biden signed an executive order on January 22, 2021 that removed schedule F, overturning a number of Trump's policies that limited the collective bargaining power of federal unions.[55][56] He called on Amazon workers to vote for union representation in a closely watched election in Alabama. This was stronger support than any president has given unions in decades. However the workers defeated the proposal 71% to 29%, enhancing Amazon's reputation as a leading bulwark against unionization. Labor activists said Biden's advocacy would build his support in the working class, fighting off Republican inroads there. [57]

Taxation and deficits

Individual taxes

Biden has pledged to raise taxes only on individual persons earning over $200,000, or $400,000 for married couples filing jointly.[46] Treasury Secretary nominee Janet Yellen reiterated Biden's pledge in her answers during her Senate confirmation hearing process in January 2021.[58] The individual tax cuts in President Trump's Tax Cuts and Jobs Act are scheduled to expire after 2025, for all income levels. This means they automatically revert to the higher rates of the Obama Administration, in the absence of new legislation.

Corporate taxes

Biden has proposed raising the corporate tax rate from 21% to 28%.[46] This rate was lowered by the Republican's 2017 Tax Cuts and Jobs Act from 35% to 21%, so Biden's proposal represents a partial reversal. The 21% tax rate does not expire, in contrast to the individual rates, so legislation would be required to raise it.[59]

International taxation

Finance officials from 130 countries agreed on July 1, 2021 to plans for a new international taxation policy. All the major economies agreed to pass national laws that would require corporations to pay at least 15% income tax in the countries they operate. This new policy would end the practice of locating world headquarters in small countries with very low taxation rates. Governments hope to recoup some of the lost revenue, estimated at $100 billion to $240 billion each year. The new system was promoted by the Biden Administration and the Organization for Economic Cooperation and Development (OECD). Secretary-General Mathias Cormann of the OECD said, "This historic package will ensure that large multinational companies pay their fair share of tax everywhere."[60]

Budget deficit

The first year that President Biden budgeted is fiscal 2022, which runs from October 1, 2021 to September 30, 2022. CBO forecast in July 2021 that the budget deficit in fiscal year 2022 will be $1.2 trillion, or 4.7% GDP.[14] This is a significant reduction to the budget deficits of $3.1 trillion (15.0% GDP) in FY2020 and $2.8 trillion (12.4% GDP) in FY2021, the last two fiscal years budgeted by President Trump. Those two record annual budget deficits were unusually high, primarily due to response measures to the Coronavirus pandemic.[61]

During February 2021, the CBO forecast budget deficits for 2021-2031, based on legislation in effect as of January 12, 2021, prior to the American Rescue Plan Act (ARPA). This represents the deficit trajectory inherited by Biden; the deficit impact of his policies may be measured against that baseline. CBO later published a baseline including the impact of ARPA.[62] OMB then published its forecast for Biden's fiscal 2022 budget, which includes ARPA plus Biden's American Jobs Plan and American Families Plan.[63] These amounts are shown in the following table:

| Federal budget deficit ($ Billions) | 2020A | 2021F | 2022F | 2023F | 2024F | 2025F | 2026F | 2027F | 2028F | 2029F | 2030F | 2031F | Total 2022-2031F |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CBO February 2021 Baseline[64] | 3,132 | 2,258 | 1,056 | 963 | 905 | 1,037 | 1,026 | 1,048 | 1,352 | 1,346 | 1,650 | 1,883 | 12,266 |

| CBO Baseline Including ARPA[62] | 3,132 | 3,423 | 1,589 | 1,083 | 972 | 1,080 | 1,036 | 1,060 | 1,375 | 1,371 | 1,674 | 1,913 | 13,153 |

| Budget FY2022 per OMB[63] | 3,129 | 3,669 | 1,837 | 1,372 | 1,359 | 1,470 | 1,414 | 1,303 | 1,424 | 1,307 | 1,477 | 1,568 | 14,531 |

Deficits in fiscal 2021 and 2022 will be significantly increased by ARPA, although the impact falls thereafter. The budget deficit is expected to fall mid-decade as pandemic-related spending fades and the economy returns to normal. Thereafter, deficits rise due to the long-term trends of an aging country (e.g., fewer workers per retiree) and healthcare costs rising faster than GDP growth.[64]

Theoretical economic perspectives

In terms of theoretical economic perspectives, Bidenomics stands in striking contrast to the previously dominant economic model, known globally as the Washington consensus, or (among its opponents) as neoliberalism.[65] Milton Friedman was the intellectual godfather, with a base in the Chicago school of economics. It was the dominant economic policy of Western nations from Ronald Reagan in the United States in the 1980s.[66] through the presidencies of Bill Clinton, George W. Bush, and Barack Obama, as well as the British leaders Margaret Thatcher, Tony Blair and David Cameron.[67][68]

According to Greg Ip of the Wall Street Journal, "Bidenomics Seeks to Remake the Economic Consensus: Declaring end to neoliberalism, new thinkers play down constraints of deficits, inflation and incentives"[69] Bidenomics draws on an even older economic heritage going back to John Maynard Keynes in the 1930s, and including Americans Walter Heller, James Tobin, and Arthur Okun in the 1960s. Versions of Keynesianism were the dominant American and British economic theory before the 1970s.[70] Politically, liberals and Democrats have leaned toward Keynes;[71] Republicans and conservatives favor the Chicago School.[72]

Macroeconomics

The old view is that the economy is built around scarcity, because the demand for labor and capital and everything else is unlimited. The to achieve full employment and faster growth, more work is needed and more incentives to work. Monetary and fiscal policy is seldom needed, since the market system naturally produces optimum results.[73] Bidenomics argues that not scarcity but slack is the main problem. The market system is typically stuck below optimal levels. Full employment and growth is held back by a lack of demand, and needs the stimulation of aggressive fiscal policies such as deficit spending, as well as monetary policies to keep cash flowing.[74][75][76]

Budget deficits

The traditional view warned against budget deficits in time of prosperity, because the pool of savings is limited. Government deficits use cash that otherwise would be invested in the private sector, and the competition between the Treasury and corporations drives up interest rates. Bidenomics holds that the developed world is awash in surplus savings, which has produced very low interest rates. Absorbing some of this huge pool of savings through large deficits will not divert private investments, and will not raise interest rates. As for tax rates, the very low interest rates makes covering the national debt much easier. [77]

Welfare state

The old view said the welfare state is a necessary evil, and should be focused on people without other resources, such as the elderly. Unemployment insurance is allowed because it covered by payroll taxes on workers who are employed, but it should be limited so that no one is tempted to turn down a job offer. The argument is that work, no matter how poorly paid, confers dignity.[78] Bidenomics says the government should be promoting the national welfare, and a critical ingredient in our society is caring for dependents – especially children and elderly parents. It is a technical flaw in the definition of Gross Domestic Product that unpaid household care is not included, even though it is so important. The Biden American Rescue Plan that became law in March 2021 includes a greatly expanded child tax credit.[79][80]

Taxation and globalization

The old view strongly emphasized the wisdom of lowering income taxes, arguing that high rates discourage work, discourage investment, slow growth, and render the U.S. less competitive in a globalized world. Furthermore the minimum wage reduces employment. The new view is that more danger comes from monopoly power, especially as exerted by the giant high tech companies such as Facebook, Google and Amazon. Taxation, regulation and anti-trust laws should be used to control them. Furthermore the status quo is creating many multi-billionaires, who largely evade taxation. The result is rapidly growing inequality that is politically and socially destabilizing.[81] The old view warns that labor unions where the monopolies to worry about and fight against; Biden has been a strong supporter of labor unions. The new view cites research to show that people paying higher tax rates do not make less effort, and high minimum wages do not reduce employment. However the minimum wage does pull millions of families out of poverty. [82] As for globalization, the new view warns that globalization raises total world output by moving American jobs to China and elsewhere. The new view warns against China as a threat to long-term American economic interests. Tariffs, which were strongly opposed in the old view, now become a useful weapon. Regarding China, Bidenomics is somewhat parallel to the Trump administration policy. [83] Ihe old view called for lowering American tax rates to remain competitive internationally . In April 2021 Biden proposed a different approach . The United States would work with the European Community, Britain, Japan and other friendly nations to form a standardized international minimum income tax. The goal is to stop the globalization process whereby companies relocate headquarters into the international host with the lowest tax.[84]

Unemployment

The traditional view warned that when fiscal policy pushes unemployment below its natural level, inflation rises and interest rates go up. The new view is that fiscal and monetary policy should be used to minimize unemployment as much as possible. The argument is that unemployment does not normally cause inflation, and if it eventually does so the social cost of unemployment is much higher than the social cost of inflation.[85]

See also

References

- Tankersley, Jim (March 22, 2021). "Biden Team Prepares $3 Trillion in New Spending for the Economy". The New York Times.

- "THE EMPLOYMENT SITUATION —DECEMBER 2020" (PDF). United States Department of Labor. January 8, 2021. Retrieved January 20, 2021.

- "Monthly Budget Review for September 2020". cbo.gov. September 2020. Retrieved January 22, 2021.

- "Biden says final passage of $1 trillion infrastructure plan is a big step forward". NPR. November 6, 2021.

- Tappe, Anneken (January 27, 2022). "The US economy grew at the fastest rate in 2021 since the Reagan administration". CNN.

- Mutikani, Lucia (January 7, 2022). "U.S. labor market eyes maximum employment despite underwhelming December payrolls". Reuters.

- Pickert, Reade (January 7, 2022). "U.S. Sees Record Job Growth in 2021 After Millions Lost in 2020". Bloomberg News.

- "2022 Economic Outlook". Goldman-Sachs. November 10, 2021.

- Jeanna Smialek (November 12, 2021). "Fastest inflation in 31 years puts more heat on Washington". New York Times.

- Tan, Weizhen (January 25, 2022). "Goldman economist says it's tough to sustain wage gains of 5% to 6% without 'meaningfully high' inflation". CNBC.

- Rubin, Gabriel T. (January 28, 2022). "U.S. Wages, Benefits Rose at Two-Decade High as Inflation Picked Up". The Wall Street Journal.

- Jeanna Smialek; Ana Swanson (January 22, 2022). "Rapid Inflation Fuels Debate Over What's to Blame: Pandemic or Policy". The New York Times.

- Emily Graffeo; Lu Wang (November 3, 2021). "S&P 500 Is Up 37% Since Biden's Election One Year Ago, Setting Presidential Record". Bloomberg News.

- CBO (November 14, 2021). "Additional information about the updated budget and economic outlook: 2021 to 2031". cbo.gov. Retrieved November 14, 2021.

- "Remarks by President Joe Biden on the October Jobs Report". whitehouse.gov. Retrieved November 7, 2021.

- FRED (December 28, 2021). "All Employees, Total Nonfarm". FRED, Federal Reserve Bank of St. Louis. Retrieved December 28, 2021.

- U.S. Bureau of Labor Statistics (January 1, 1948). "Civilian Unemployment Rate". FRED, Federal Reserve Bank of St. Louis. Retrieved June 4, 2019.

- U.S. Bureau of Labor Statistics (January 1, 1948). "Unemployment level". FRED, Federal Reserve Bank of St. Louis. Retrieved June 20, 2020.

- "Real Gross Domestic Product". fred.stlouisfed.org. Retrieved December 28, 2021.

- "CPI All". fred.stlouisfed.org. December 27, 2021. Retrieved December 27, 2021.

- "Average Hourly Earnings of Production and Non-Supervisory Employees, Total Private". fred.stlouisfed.org. December 27, 2021. Retrieved December 27, 2021.

- "CBO Budget & Economic Outlook July 2021 Update". fred.stlouisfed.org. July 2021. Retrieved December 28, 2021.

- "S&P 500". fred.stlouisfed.org. June 3, 2019. Retrieved June 4, 2019.

- "Monthly Statement of the Public Debt". treasurydirect.gov. December 28, 2021. Retrieved December 28, 2021.

- Fowers, Alyssa; Long, Heather; Schaul, Kevin (March 10, 2021). "How big is the Biden stimulus bill? And who gets the most help?". Washington Post. ISSN 0190-8286. Retrieved March 11, 2021.

- Tankersley, Jim (March 6, 2021). "To Juice the Economy, Biden Bets on the Poor". The New York Times. ISSN 0362-4331. Retrieved March 11, 2021.

- "New Monthly Child Tax Credits Are Starting To Go Out. Here's What It Means For Your Family". npr.org. Retrieved July 20, 2021.

- Cochrane, Emily (March 6, 2021). "Divided Senate Passes Biden's Pandemic Aid Plan". The New York Times. ISSN 0362-4331. Retrieved March 11, 2021.

- "Pandemic Bill Would Cut Taxes by An Average of $3,000, With Most Relief Going to Low- And Middle-Income Households". taxpolicycenter.org. Retrieved April 25, 2021.

- "Fact Sheet: The American Jobs Plan". The White House. Retrieved April 20, 2021.

- "What's in President Biden's American Jobs Plan?". CRFB. Retrieved April 20, 2021.

- "Fact Sheet: The American Families Plan". The White House. Retrieved May 1, 2021.

- "Biden's $4 Trillion Economic Plan, in One Chart". nytimes.com. Retrieved April 20, 2021.

- "Everything in the House Democrats' Budget Bill". nytimes.com. November 18, 2021.

- "President Biden's Full FY 2022 Budget". crfb.org.

- "Fact Sheet: President Biden's New Executive Actions Deliver Economic Relief for American Families and Businesses Amid the COVID-19 Crises". whitehouse.gov. January 22, 2021. Retrieved January 23, 2021.

- "The Effects on Employment and Family Income of Increasing the Federal Minimum Wage". cbo.gov. July 8, 2019. Retrieved January 22, 2021.

- Nandita Bose; Jarrett Renshaw (April 27, 2021). "Biden raising minimum wage for federal contractors to $15/hr". Reuters.

- "Nearly 400,000 federal contractors will get paid $15 an hour starting this weekend. Biden's labor secretary says there's 'no question' it'll cut down on labor shortages". Business Insider. January 28, 2022.

- Davis, Bob (January 24, 2021). "Biden Team Promises New Look in Trade Policy". The Wall Street Journal. Retrieved January 26, 2021.

- Allen-Ebrahimian, Bethany (January 26, 2021). "Biden set his sights on China". Axios. Retrieved January 26, 2021.

- Swanson, Ana (January 26, 2021). "Biden's Commerce Pick Vows to Combat China and Climate Change". The New York Times. Retrieved January 26, 2021.

- Davis, Bob; Hayashi, Yuka (March 28, 2021). "New Trade Representative Says U.S. Isn't Ready to Lift China Tariffs". The Wall Street Journal. Retrieved March 29, 2021.

- Swanson, Ana; Rogers, Katie (October 30, 2021). "U.S. Agrees to Roll Back European Steel and Aluminum Tariffs" – via NYTimes.com.

- Zumbrun, Josh (December 31, 2021). "Beijing Fell Short on Trade Deal Promises, Creating Dilemma for Biden". The Wall Street Journal.

- "This is the future Joe Biden wants". Vox. August 17, 2020. Retrieved January 22, 2021.

- "Biden Wants To Help Pay Some Student Loans, But There's Pressure To Go Further". npr.org. November 17, 2020. Retrieved January 23, 2021.

- "Who Borrows for College—and Who Repays?". newyorkfed.org. October 9, 2019. Retrieved January 23, 2021.

- "Canceling Student Loan Debt Is Poor Economic Stimulus". crfb.org. November 2020. Retrieved January 23, 2021.

- "Experts weigh in on Biden's support of $10,000 in student debt forgiveness". cnbc.com. January 22, 2021. Retrieved January 24, 2021.

- Quintana, Chris (January 20, 2022). "Student loan forgiveness has arrived for 70,000 borrowers working public service jobs". USA Today.

- "Biden Wants To Lower Medicare Eligibility Age To 60, But Hospitals Push Back". npr.org. November 11, 2021. Retrieved January 23, 2021.

- Nagarajan, Shalini. "Biden freezes all federal regulatory proposals, including Mnuchin's controversial crypto wallet legislation, until his new administration can review them". Business Insider. Retrieved January 24, 2021.

- Lee, Timothy B. (January 20, 2021). "Treasury nominee Yellen is looking to curtail use of cryptocurrency". Ars Technica. Retrieved January 24, 2021.

- Wagner, Erich (January 22, 2021). "Biden to Sign Executive Order Killing Schedule F, Restoring Collective Bargaining Rights". Government Executive. Retrieved January 22, 2021.

- Ogrysko, Nicole (January 22, 2021). "Biden to repeal Schedule F, overturn Trump workforce policies with new executive order". Federal News Network. Retrieved January 22, 2021.

- Sean Sullivan, "Biden took a chance in promoting the Amazon union push. What does its failure mean for him?" Washington Post April 10, 2021.

- "What Janet Yellen is saying about raising taxes on wealthy Americans—and other key issues—as Biden's Treasury Secretary-designate". fortune.com. January 21, 2021. Retrieved January 22, 2021.

- Garrett Watson and William McBride, "Evaluating Proposals to Increase the Corporate Tax Rate and Levy a Minimum Tax on Corporate Book Income," FISCAL FACT (Tax Foundation, No. 751 Feb. 2021)

- Paul Hannon and Kate Davidson, "U.S. Wins International Backing for Global Minimum Tax." Wall Street Journal July 1, 2021

- CBO (November 8, 2021). "Monthly Budget Review: Summary for Fiscal Year 2021". cbo.gov. Retrieved November 14, 2021.

- CBO (May 21, 2020). "Three Scenarios for the Budget as Specified by Senator Graham". cbo.gov. Retrieved May 31, 2021.

- "President's Budget". whitehouse.gov. May 28, 2021. Retrieved May 31, 2021.

- CBO (February 11, 2021). "The Budget and Economic Outlook: 2021 to 2013". cbo.gov. Retrieved March 28, 2021.

- People rarely call themselves "neoliberal" says Oliver Marc Hartwich, "Neoliberalism: The genesis of a political swearword." (CIS Occasional Paper 114. 2009) online.

- Monica Prasad, "The popular origins of neoliberalism in the Reagan tax cut of 1981." Journal of Policy History 24.3 (2012): 351-383.

- Greg Ip, 2021

- Wesley Widmaier, "The power of economic ideas–through, over and in–political time: the construction, conversion and crisis of the neoliberal order in the US and UK." Journal of European Public Policy 23.3 (2016): 338-356.

- Greg Ip, 2021

- Thomas I. Palley, "From Keynesianism to Neoliberalism: Shifting Paradigms in Economics" in Alfredo Saad-Filho, and Deborah Johnston, eds., Neoliberalism--A Critical Reader (Pluto Press, 2004) pp 20–29.

- Margaret Weir, "Ideas and Politics: The Acceptance of Keynesianism in Britain and the United States." in The Political Power of Economic Ideas (Princeton UP, 2020) pp. 53-86.

- Daniel Stedman Jones, Masters of the Universe: Hayek, Friedman and the Birth of Neoliberal Politics (2012) pages x, 146; excerpt.

- Nicholas Xenos, "Liberalism and the Postulate of Scarcity." Political theory 15.2 (1987): 225-243.

- Greg Ip, "How Bidenomics Seeks to Remake the Economic Consensus," Wall Street Journal April 8, 2021.

- J.W. Mason, "Macroeconomic lessons from the past decade" in Aggregate Demand and Employment (Edward Elgar, 2020) pp 11–33.

- Michael Rainey, "A Quick Guide to ‘Bidenomics'" The Fiscal Times April 8, 2021

- Greg Ip, 2021.

- Hartman, Yvonne (2005). "In bed with the enemy: Some ideas on the connections between neoliberalism and the welfare state". Current Sociology. 53 (1): 57–73. CiteSeerX 10.1.1.986.9857. doi:10.1177/0011392105048288. S2CID 145662662.

- Greg Ip, 2021.

- Andrea Shalal, "Top White House economist defends 'care economy' as infrastructure" Reuters April 6, 2021

- Oxford Analytica. "Biden's top picks to shape 'big tech' antitrust agenda." Emerald Expert Briefings oxan-db (2021) https://doi.org/10.1108/OXAN-DB258983 .

- Greg Ip, 2021.

- Thomas Gift, "Joe Biden's approach to China will not differ greatly from Donald Trump's." USApp–American Politics and Policy (2020) online.

- Paul Hannon and Richard Rubin, "Tax Talks Gain Momentum as U.S. Offers New Proposal Toward Global Deal: Proposal focuses on how to tax corporate income whose location is difficult to pin down," Wall Street Journal April 8, 2021

- Greg Ip, 2021.

Further reading

- Ip, Greg. "How Bidenomics Seeks to Remake the Economic Consensus: Declaring end to neoliberalism, new thinkers play down constraints of deficits, inflation and incentives" Wall Street Journal April 7, 2021

- Watson, Garrett and William McBride. "Evaluating Proposals to Increase the Corporate Tax Rate and Levy a Minimum Tax on Corporate Book Income," FISCAL FACT (Tax Foundation, No. 751 Feb. 2021)

.jpg.webp)