Dedollarisation

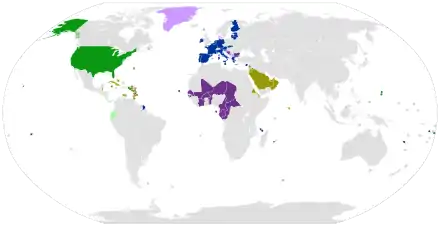

Dedollarisation is a process of substituting US dollar as the currency used for (i) trading oil and/ or other commodities (i.e. petrodollar), (ii) buying US dollars for the forex reserves, (iii) bilateral trade agreements, and (iv) dollar-denominated assets.

The U.S. dollar began to displace the pound sterling as international reserve currency from the 1920s since it emerged from the First World War relatively unscathed and since the United States was a significant recipient of wartime gold inflows.[1] After the U.S. emerged as an even stronger global superpower during the Second World War, the Bretton Woods Agreement of 1944 established the post-war international monetary system, with the U.S. dollar ascending to become the world's primary reserve currency for international trade, and the only post-war currency linked to gold at $35 per troy ounce.[2] Despite all links to gold being severed in 1971, the dollar continues to play this role to this day.

Since the establishment of Bretton Woods system, the US dollar is used as the medium for international trade. The United States Department of the Treasury exercises considerable oversight over the SWIFT financial transfers network,[3] and consequently has a huge sway on the global financial transactions systems, with the ability to impose sanctions on foreign entities and individuals.[4] In recent years, several countries are transitioning to trade in national currencies.

Devaluation of the dollar

Under the Bretton Woods system established after World War II, the value of gold was fixed to $35 per ounce, and the value of the U.S. dollar was thus anchored to the value of gold. Rising government spending in the 1960s, however, led to doubts about the ability of the United States to maintain this convertibility, gold stocks dwindled as banks and international investors began to convert dollars to gold, and as a result, the value of the dollar began to decline. Facing an emerging currency crisis and the imminent danger that the United States would no longer be able to redeem dollars for gold, gold convertibility was finally terminated in 1971 by President Nixon, resulting in the "Nixon shock".[5]

The value of the U.S. dollar was therefore no longer anchored to gold, and it fell upon the Federal Reserve to maintain the value of the U.S. currency. The Federal Reserve, however, continued to increase the money supply, resulting in stagflation and a rapidly declining value of the U.S. dollar in the 1970s. This was largely due to the prevailing economic view at the time that inflation and real economic growth were linked (the Phillips curve), and so inflation was regarded as relatively benign.[5] Between 1965 and 1981, the U.S. dollar lost two thirds of its value.[6]

Regional developments

On March 17, 2022, Anatoly Aksakov, Chairman of the State Duma Committee on the Financial Market, announced that the Bank of Russia and the People's Bank of China are working on connecting the Russian and Chinese financial messaging systems. He also pointed to the beginning of the development of information transfer schemes using blockchains, including the digital ruble and the digital yuan.[7] On March 31, 2022, the Economic Times published information that India has offered Russia a new transaction system with the transfer of trade to the ruble and SPFS, which will work through the Reserve Bank of India and Russia's Vnesheconombank. According to the same data, the system will be put into operation within a week.[8]

Australia

.[9]

Brazil

In 2013, during the BRICS summit, Brazil made an agreement with China to trade in Brazilian real and Chinese yuan[10]

China

Since 2011, China is gradually shifting from trade in US dollar and in favour of Chinese yuan.[9] It made agreements with Australia, Russia, Japan, Brazil, and Iran to trade in national currencies. It has been reported that in the first quarter of 2020 the share of the dollar in the bilateral trade between China and Russia fell below 50 percent for the first time.[11][12]

In 2015, China launched CIPS, a payment system which offers clearing and settlement services for its participants in cross-border Renminbi payments and trade as an alternative to SWIFT.[13] [14]

European Union

Since the end of 2019, the EU countries established INSTEX, a European special-purpose vehicle (SPV) to facilitate non-USD and non-SWIFT[15][16] transactions with Iran to avoid breaking U.S. sanctions.[17] On 11 February 2019, Russian deputy foreign minister Sergei Ryabkov stated that Russia would be interested in participating in INSTEX.[18]

India

Before 1991 Soviet Union and India traded in rupee-ruble exchange during Cold War as both belong to socialist block. Mutual trading between India and Russia is done mostly in rubles and rupees instead of dollars and euros.

In March 2022, India and Russia entered for a Rupee - Rouble Trade Arrangement[19]

Iran

Since March 2018, China started buying oil in gold-backed yuans.[20]

On 31 March 2020, the first Iran-EU INSTEX transaction was concluded. It covered an import of medical equipment to combat the COVID-19 outbreak in Iran.[21][22]

Japan

In 2011, Japan made an agreement with China to trade in national currencies.[23] Sino-Japanese trade is currently worth ~US$300 billion.[24]

Russia

Russia accelerated the process of dedollarisation in 2014 as a result of worsening relations with the West.[25] In 2017, SPFS, a Russian equivalent of the SWIFT financial transfer system, was developed by the Central Bank of Russia.[26] The system has been in development since 2014, after the United States government threatened to disconnect Russia from the SWIFT system.[27] Lukoil, a state-owned company, has announced that it will find a replacement for the dollar.[28]

In June 2021, Russia said it will eliminate the dollar from its National Wealth Fund to reduce vulnerability to Western sanctions just two weeks before President Vladimir Putin held his first summit meeting with U.S. leader Joe Biden.[29]

On March 23, 2022, Vladimir Putin signed an order forbidding "non-friendly" countries (including EU countries, USA and Japan) from buying Russian gas in any other currency besides Russian ruble.

Saudi Arabia

In March 2022, multiple reports claimed that Saudi Arabia were in talks with China about trading Saudi oil and gas to China in Chinese yuans instead of dollars.

References

- Eichengreen, Barry; Flandreau, Marc (2009). "The rise and fall of the dollar (or when did the dollar replace sterling as the leading reserve currency?)". European Review of Economic History. 13 (3): 377–411. doi:10.1017/S1361491609990153. ISSN 1474-0044. S2CID 154773110.

- "How a 1944 Agreement Created a New World Order".

- "SWIFT oversight".

- "Sanctions Programs and Country Information | U.S. Department of the Treasury".

- "Controlling Inflation: A Historical Perspective" (PDF). Archived from the original (PDF) on December 7, 2010. Retrieved July 17, 2010.

- "Measuring Worth – Purchasing Power of Money in the United States from 1774 to 2010". Retrieved April 22, 2010.

- "Россия и Китай смогут обмениваться платежами без SWIFT | Bigasia.ru". bigasia.ru. Retrieved 2022-04-01.

- "СМИ: Россия и Индия обсуждают внедрение альтернативной системы транзакций". tass.ru. Retrieved 2022-04-01.

- "News". australianbusiness.com.au. Retrieved 2019-10-26.

- "So Long, Yankees! China And Brazil Ditch US Dollar In Trade Deal Before BRICS Summit". ibtimes.com. Retrieved 2019-10-26.

- Алферова, Екатерина (2020-07-29). "Доля доллара в торговле РФ и Китая впервые опустилась ниже 50%". Известия (in Russian). Retrieved 2020-07-30.

- "China and Russia ditch dollar in move toward 'financial alliance'". Nikkei Asia. Retrieved 2022-03-30.

- sina_mobile (2019-05-23). "865家银行加入人民币跨境支付系统 去年交易额26万亿". finance.sina.cn. Retrieved 2020-08-02.

- Service, Canadian Security Intelligence (2018-05-15). "Beijing creates its own global financial architecture as a tool for strategic rivalry". www.canada.ca. Retrieved 2022-03-30.

- "European powers launch mechanism for trade with Iran". Reuters. 31 January 2019.

- Girardi, Annalisa (9 April 2019). "INSTEX, A New Channel To Bypass U.S. Sanctions And Trade With Iran". Forbes.

- Coppola, Frances (30 June 2019). "Europe Circumvents U.S. Sanctions On Iran". Forbes.

- "Рябков: РФ будет добиваться участия в механизме внешнеторговых расчетов INSTEX с Ираном" [Ryabkov: Russia will seek participation in the mechanism of foreign trade settlements INSTEX with Iran]. TASS (in Russian). 11 February 2019. Retrieved 11 February 2019.

- Buddhavarapu, Ravi (2022-03-23). "An Indian rupee-ruble trade arrangement with Russia may be ready in a week". CNBC. Retrieved 2022-03-27.

- "China Prepares Death Blow To The Dollar". OilPrice.com. Retrieved 2019-10-26.

- "INSTEX successfully concludes first transaction". GOV.UK. Foreign & Commonwealth Office. 31 March 2020.

- "European countries to send medical aid to Iran in first INSTEX transaction". AMN. 31 March 2020. Retrieved 31 March 2020.

- "China, Japan to trade in own currencies". UPI.com. Retrieved 2019-10-26.

- "OEC". oec.world. Retrieved 2019-10-26.

- "Russia to cut share of U.S. dollar in National Wealth Fund, mulls other currencies". Reuters. 13 November 2019.

- Aitov, Timur (15 March 2018). "Натянутая струна. Возможно ли отключение России от SWIFT". Forbes.ru. Retrieved 4 October 2018.

- Turak, Natasha (23 May 2018). "Russia's central bank governor touts Moscow alternative to SWIFT transfer system as protection from US sanctions". CNBC. Retrieved 4 October 2018.

- Gleb Gorodyankin. "Exclusive: Russian oil firm seeks dollar alternative amid U.S. sanctions threat - traders". Reuters. Retrieved 2019-10-26.

- Pismennaya, Evgenia; Andrianova, Anna. "Russia Cuts Dollar Holdings From $119 Billion Wealth Fund Amid Sanctions". www.bloomberg.com. Retrieved 5 June 2021.

- "US dollars no longer a quote currency in Venezuela". Xinhua Net. 18 October 2018. Retrieved 19 October 2018.

- "Fintech is the new oil in the Middle East and North Africa". Forbes. Retrieved 10 April 2019.